International Business Machines Corporation (IBM), a stalwart in the technology sector, is listed on the New York Stock Exchange (NYSE). Established in 1911, IBM has evolved into a leading provider of hybrid cloud and artificial intelligence (AI) solutions, along with comprehensive business services. With a corporate address at 1 New Orchard Rd, Armonk, NY 10504, USA, IBM operates on a global scale. Operating within the software and IT services industry, the company boasts a vast workforce of 311,300 employees.

The company's diverse offerings are structured across key segments:

Software: Encompasses Hybrid Platform & Solutions and transaction processing, providing clients with IT resource optimization and mission-critical software solutions for various industries.

Consulting: Engaged in business transformation, technology consulting, and application operations.

Infrastructure: Focused on hybrid infrastructure and infrastructure support.

Financing: Offers client financing and commercial financing solutions.

Market Capitalization and Stock Performance:

IBM's financial stature is evident in its market capitalization, standing at an impressive $151.40 billion USD. The Price-to-Earnings (P/E) ratio for the trailing twelve months is 22.14, showcasing a balanced valuation. The Earnings Per Share (EPS) for the same period is reported at $7.49. Additionally, IBM offers an enticing forward dividend yield of 6.64%, with a 4.00% dividend yield.

The company's commitment to shareholder value is further emphasized by its Ex-Dividend Date, which was on November 9, 2023. In the third quarter of 2023, IBM demonstrated robust financial performance. The company reported $ Mkt Cap 151.4B, a substantial revenue of noteworthy 4.60% year-over-year growth. The net income for the same period reached $1.7 billion, underlining IBM's profitability and financial resilience in a dynamic market environment.

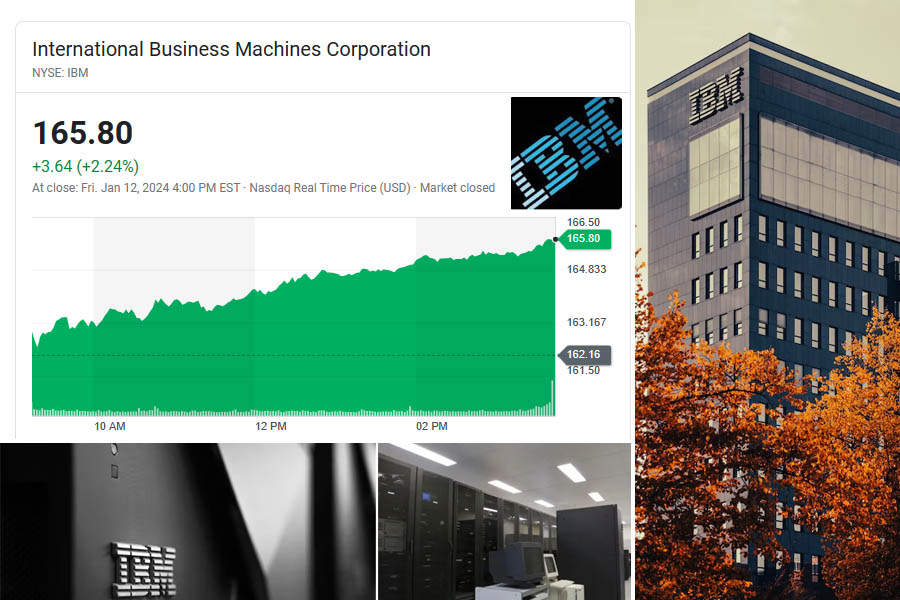

Share Price Development:

As of January 12, 2024, International Business Machines Corp (IBM) is trading on the New York Stock Exchange (NYSE) with a share price value of $165.80. This reflects a slight increase from the previous closing price of $162.16. Over the past 52 weeks, IBM's stock has demonstrated a range of performance, with a low price of $120.55 and a high price of $166.34. The current share value underscores IBM's position in the market and its ability to navigate various market conditions.

Investor Outlook and Analysis:

IBM has maintained a solid market capitalization of $151.40 billion, reflecting investor confidence. The Price-to-Earnings (P/E) ratio of 22.14 suggests a balanced valuation, while the earnings per share (EPS) of $7.49 showcases the company's profitability.

Investors are attracted by IBM's robust forward dividend yield of 6.64%, demonstrating the company's commitment to returning value to shareholders. The ex-dividend date on November 9, 2023, underlines its regular dividend distribution.

Historical Performance and Target Price:

IBM's historical financial performance, coupled with its strategic positioning in emerging technologies, makes it an intriguing investment. Analysts project a target price indicative of a positive trajectory, aligning with IBM's historical stability and future growth prospects.

International Business Machines Corp stands as a technological juggernaut, leveraging its century-long legacy to drive innovation in the ever-evolving landscape of IT services. As IBM continues to navigate the NYSE, its hybrid cloud and AI offerings position it as a key player in shaping the future of technology. Amidst its peers in the technology and consulting landscape, IBM stands out with a solid track record of surpassing earnings estimates. The company's recent financial performance, exemplified by an average surprise of 6.39% in the past two quarters, positions it as a consistent outperformer. Investors are closely monitoring IBM's trajectory, considering its recent stock performance and the dynamics of the Computer - Integrated Systems industry.

Beyond the immediate stock movements, it's crucial to recognize that while beating consensus estimates is a notable achievement, other fundamental factors contribute to a company's long-term viability. The forward-looking approach, considering earnings estimate revisions, revenue growth, and valuation metrics, provides a holistic perspective for investors. As IBM is expected to post earnings of $3.73 per share for the current quarter, with a year-over-year change of +3.6%, and the consensus earnings estimate for the current fiscal year and the next indicates positive growth, the company's potential for sustained success is evident.

In conclusion, IBM's ability to consistently outperform earnings estimates, coupled with a positive outlook for future growth, positions it as an attractive investment opportunity. As investors assess the landscape, evaluating factors beyond short-term stock movements will be key to making informed and strategic decisions in the ever-evolving market.