NVIDIA Corporation (NVDA), a leading technology company listed on the NASDAQ stock exchange, has been a driving force in the industry, consistently achieving milestones and garnering investor attention. NVIDIA Corp, headquartered in Santa Clara, California, is led by CEO Jensen Huang, overseeing a workforce of over 26,000 employees. With a market capitalization of 1.21 trillion USD, the company boasts strong financials, with an Earnings Per Share of 4.02, revenue totaling 18.12 billion USD (as of October 2023), and a net income reaching 9.24 billion USD. Here's an overview of various facets of NVIDIA's performance:

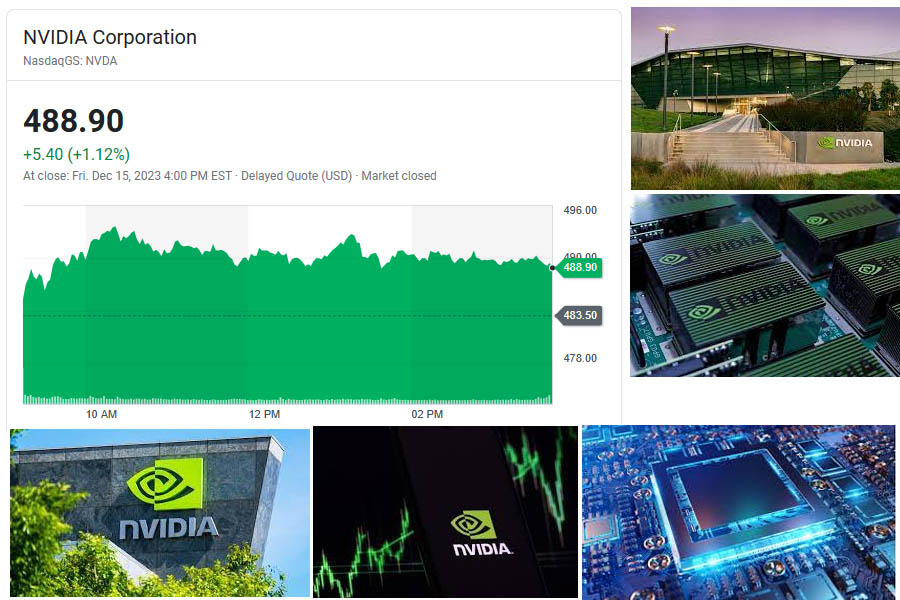

Share Price Development: As of today, NVIDIA Corporation (NasdaqGS: NVDA) is valued at $488.90 per share, reflecting a marginal increase from the previous closing price of $483.50. Over the past 52 weeks, the stock has demonstrated a range from a low of $138.84 to a high of $505.48, showcasing its resilience and volatility in the market.

NVIDIA's share price has witnessed remarkable growth over the past year, reflecting the company's prowess in the technology sector. Monthly and weekly charts reveal a dynamic trajectory, attesting to the market's response to NVIDIA's innovations and strategic moves.

Company Profile:

Headquartered in Santa Clara, California, NVIDIA is renowned for its cutting-edge graphics processing units (GPUs) and artificial intelligence (AI) technologies. The company's products are integral to a wide range of applications, from gaming to data centers, positioning NVIDIA as a key player in the evolving tech landscape.

Historical Financial Performance:

NVIDIA's historical financial performance is marked by consistent growth and innovation. The company has demonstrated its ability to adapt to changing market demands, leading to a sustained positive trajectory. Investors often view NVIDIA as a technology stock with a track record of delivering solid financial results.

Target Price and Analysts' Projections:

Analysts closely monitor NVIDIA's performance and have set a target price based on their assessment of the company's future potential. The target price serves as a benchmark for investors, guiding them in their decisions. NVIDIA's innovative strides and market position contribute to optimistic analyst recommendations.

Investors and Stakeholders:

NVIDIA has attracted a diverse range of investors, from institutional stakeholders to individual tech enthusiasts. The company's presence in transformative technologies like AI and gaming has made it an appealing choice for investors seeking exposure to the dynamic and rapidly growing tech sector.

Strategic Analysis and Future Outlook:

A thorough analysis of NVIDIA suggests a positive outlook, driven by its advancements in GPU technology, AI, and data center solutions. The company's strategic acquisitions and partnerships reinforce its commitment to staying at the forefront of technological innovation, positioning NVIDIA for continued success in the future.

NVIDIA Corporation's listing on NASDAQ reflects a company that has not only embraced but has also driven technological evolution. With a robust share price, a history of financial strength, and a strategic vision, NVIDIA remains a prominent player in the tech industry, attracting investors looking for innovation and sustained growth in their portfolios.