Nordstrom Inc (NYSE: JWN), a prominent player in the retail industry, has captivated the attention of investors on the NEW YORK STOCK EXCHANGE Stock Market. In this comprehensive analysis, we explore various facets of Nordstrom's performance, including share price dynamics, yearly, monthly, and weekly developments, company profile, target price, historical financial performance, key investors, and strategic analysis.

Share Price Dynamics:

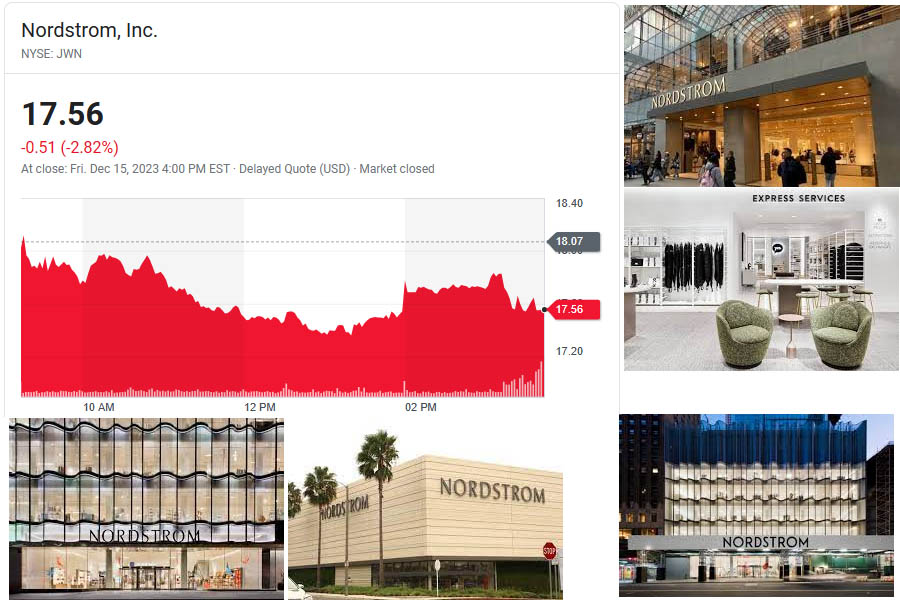

Nordstrom's share price on the NYSE Stock Market is a reflection of its performance in the retail sector. Investors closely monitor the stock's movements, influenced by market conditions, industry trends, and company-specific developments. Understanding the dynamics of Nordstrom's share price provides valuable insights into investor sentiment.

Yearly, Monthly, and Weekly Developments: As of today, Nordstrom, Inc. (NYSE: JWN) holds a share price value of $17.56 on the New York Stock Exchange, with a previous closing price of $18.07. Over the past 52 weeks, the stock has fluctuated between a low of $12.88 and a high of $27.15.

Analyzing Nordstrom's share price on different timeframes is crucial for investors seeking to understand both short-term fluctuations and long-term trends. Yearly assessments reveal the company's overall performance, while monthly and weekly developments provide insights into recent market sentiment and investor reactions to news and events.

Company Profile:

Nordstrom, founded in 1901, has evolved into a leading fashion retailer known for its commitment to quality and customer service. With a strong presence in both physical stores and e-commerce, Nordstrom has adapted to the changing retail landscape, offering a wide range of high-end and affordable fashion options.

Target Price and Analysts' Projections:

Investors often rely on target prices and analysts' projections to make informed decisions. Analysts evaluate Nordstrom's financial health, competitive positioning, and market trends to provide estimates of the stock's potential future value. Monitoring these projections can offer valuable guidance for investors.

Historical Financial Performance:

A look into Nordstrom's historical financial performance unveils its resilience and adaptability. Examining key financial indicators over time provides insights into the company's ability to navigate economic cycles and industry challenges.

Investors and Strategic Analysis:

Understanding Nordstrom's investor base and strategic initiatives is crucial for gauging the company's direction. Whether institutional or individual investors, their confidence in Nordstrom's future prospects shapes the stock's overall performance. Additionally, strategic analyses shed light on Nordstrom's efforts to stay competitive in the ever-evolving retail landscape.

As Nordstrom Inc continues its journey on the NYSE Stock Market, investors and analysts alike remain vigilant, observing share price dynamics, company developments, and market trends. This comprehensive analysis serves as a guide for those seeking a deeper understanding of Nordstrom's performance and its positioning in the retail industry on the NYSE Stock Market.