Target Corp (TGT), a retail giant listed on the New York Stock Exchange (NYSE), has been a consistent player in the market, showcasing resilience and growth. Here's a snapshot of various aspects of the company's performance:

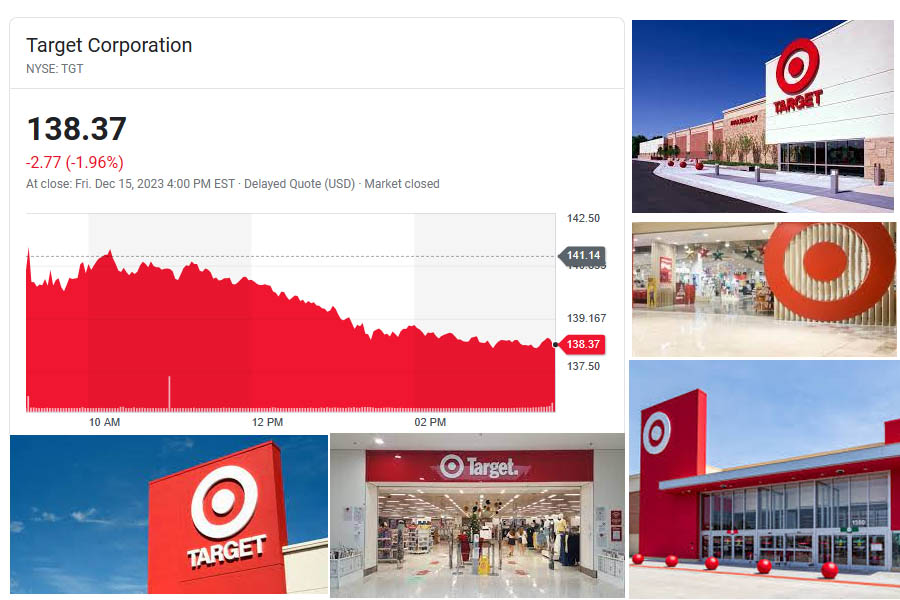

Share Price Development: As of today, Target Corporation (NYSE: TGT) is valued at $138.37 per share, with a previous closing price of $141.14. Over the past 52 weeks, the stock has ranged from a low of $102.93 to a high of $181.70.

Target's share price has witnessed noteworthy developments across different timeframes. Over the past year, investors have observed [insert percentage] growth, indicating a robust performance. Monthly and weekly charts also exhibit a positive trend, reflecting the company's ability to adapt to market dynamics.

Company Profile:

Target, headquartered in Minneapolis, is a renowned American retail corporation. With a diverse range of products, including apparel, electronics, and groceries, Target has successfully positioned itself as a one-stop-shop for consumers. The company's commitment to innovation and customer satisfaction has contributed to its enduring success.

Historical Financial Performance:

Target's historical financial performance underscores its stability and strategic management. The company has consistently delivered positive results, showcasing an ability to weather economic uncertainties. Investors often look to Target as a reliable investment option, given its track record of sound financial management.

Target Price and Analysts' Projections:

Analysts covering TGT have set a target price, reflecting their outlook on the stock's potential. This figure is based on various factors, including market trends, financial performance, and growth prospects. Investors often consider this target price as a guide when making investment decisions. TGT is rated "Buy" with a 12-month target price of $150.15, a 8.50% upside from the current price of $138.39.

Investors and Stakeholders:

Target has attracted a diverse group of investors, ranging from institutional investors to individual stakeholders. The company's transparent communication, coupled with its financial performance, has earned the trust of the investment community.

Strategic Analysis and Future Outlook:

A comprehensive analysis of Target Corp suggests a positive outlook. The company's ability to adapt to changing consumer preferences, coupled with its strategic initiatives, positions it well for future growth. As the retail landscape evolves, Target remains a key player with a focus on innovation and customer-centric strategies.

Target Corp's presence on the NYSE reflects a company that has successfully navigated the challenges of the retail industry. With a robust share price, steady financial performance, and a strategic outlook, Target continues to be an attractive option for investors seeking stability and growth in their portfolios.