In a bold move signaling its commitment to U.S. market dominance, Temu, the rapidly growing Chinese-backed retail platform, is gearing up for a second consecutive appearance during the Super Bowl on Feb. 11. This strategic investment, led by Temu's parent company, PDD Holdings, highlights the brand's aggressive approach to expanding its footprint in the traditional advertising space.

Super Bowl LVIII, scheduled to air on CBS, commands top dollar for ad slots, with prices ranging from $6 million to a staggering $7.2 million for a 30-second spot. Despite discussions around the Super Bowl plans, Temu is yet to officially confirm its participation, according to a company spokesman.

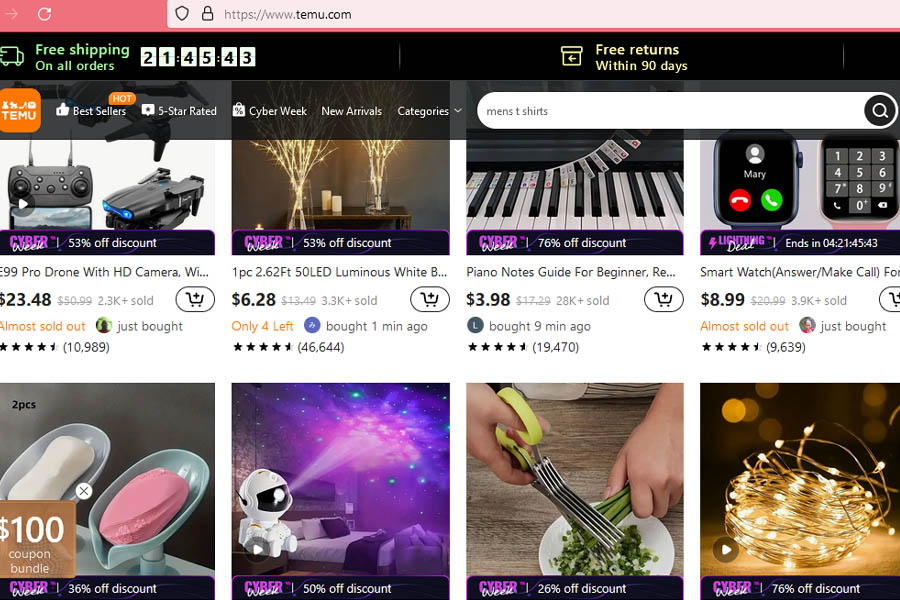

Temu's extensive digital advertising efforts throughout the past year have played a pivotal role in influencing online ad costs, with notable impacts on platforms like Google and Meta, as acknowledged by industry leaders. The e-commerce giant, along with its rival Shein, has been a major player in reshaping the landscape of online advertising.

A substantial portion of Temu's digital ad spend this year has been directed toward Facebook (46%), Instagram (22%), and YouTube (15%), according to Sensor Tower, a market intelligence firm. Temu made its Super Bowl debut earlier this year with a 30-second ad, "Shop Like a Billionaire," which, despite mixed reviews, catapulted the app to the most-downloaded status on Apple and Google app stores.

With over 50 million cumulative global downloads and ranking as the fourth most-visited retail site in the U.S., Temu's aggressive marketing strategy seems to be paying off. The company's overarching goal is to leverage a substantial ad budget, funded by PDD's robust financial backing, to establish a significant presence in the U.S. and other markets.

Sky Canaves, Senior Analyst at Insider Intelligence, emphasizes Temu's focus on customer acquisition and the strategic utilization of customer data to enhance competitiveness. Despite claims of inaccurate reports regarding transaction losses, Temu remains dedicated to turning its business into a sustainable venture.

Temu's approach mirrors the successful market-share acquisition strategy employed by PDD when it launched the Pinduoduo app in 2015. The emphasis on promoting discounts on clothing and household goods rather than fast shipping positions Temu and its rivals as formidable contenders against Western giants like Amazon.

The Super Bowl investment aligns with Temu's larger vision of transforming an initially unprofitable venture into a lucrative business by using advertising to secure a massive customer base. As the company navigates the challenges of reducing reliance on expensive ads, particularly its Super Bowl campaigns, convincing renowned brands to participate on its platform remains a hurdle.

Temu, headquartered in Boston, operates under the umbrella of PDD Holdings, which recently moved its headquarters from Shanghai to Dublin. With PDD reporting a 94% growth in third-quarter revenue year-on-year, Goldman Sachs now values Temu at an impressive $37 billion, marking a substantial increase from its previous valuation of $20 billion. As the Super Bowl approaches, all eyes are on Temu to see how this advertising powerhouse will further shape the e-commerce landscape and solidify its position in the global market.