Tesla, Inc. (TSLA), a trailblazer in the electric vehicle and renewable energy sectors, has consistently captured market attention with its innovative products and disruptive technologies. Based in Austin, Texas, Tesla, Inc. stands as an American multinational automotive and clean energy juggernaut. The company, founded by Marc Tarpenning and Martin Eberhard, specializes in the design and manufacturing of electric vehicles, stationary battery energy storage devices spanning from home to grid-scale, solar panels, solar shingles, and a range of related products and services. With an expansive workforce of 127,855 employees, Tesla boasts a substantial market capitalization of 794.33 billion USD, a P/E ratio of 81.69, and has reported a revenue of 23.35 billion USD as of November 2023, with a net income of 1.85 billion USD. Here's a comprehensive overview of various facets of Tesla's performance:

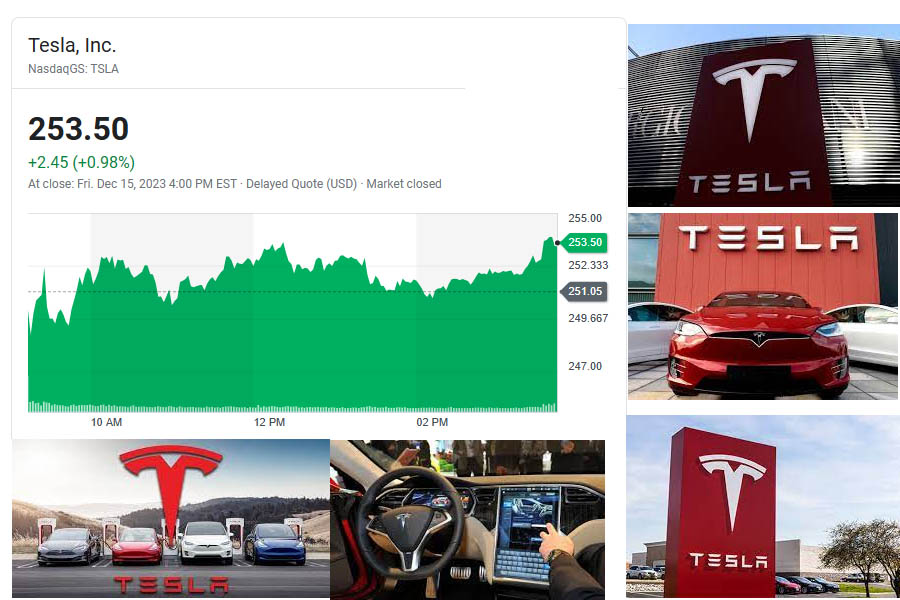

Share Price Development: As of today, Tesla, Inc. (NasdaqGS: TSLA) is valued at $253.50 per share, experiencing a marginal increase from the previous closing price of $251.05. Over the past 52 weeks, the stock has ranged from a low of $101.81 to a high of $299.29, reflecting both its volatility and resilience in the market.

Tesla's share price has exhibited extraordinary growth over the past year, reflecting the company's leadership in the electric vehicle market. Monthly and weekly charts illustrate dynamic movements, showcasing the market's response to Tesla's advancements in technology and sustainable energy solutions.

Company Profile:

Headquartered in Palo Alto, California, Tesla is synonymous with electric vehicles, energy storage, and solar products. Founded by Elon Musk, the company has revolutionized the automotive industry with its sleek electric cars, while also playing a pivotal role in advancing clean energy solutions.

Historical Financial Performance:

Tesla's financial journey is marked by both challenges and triumphs. The company's ability to disrupt traditional automotive and energy sectors has translated into robust financial results. Tesla's financial performance is closely scrutinized as it continues to shape the future of sustainable transportation.

Target Price and Analysts' Projections:

Analysts closely monitor Tesla's stock, providing target prices based on their assessments of the company's potential. Given Tesla's ambitious plans for expansion and innovation, analyst recommendations often reflect a positive outlook, contributing to the stock's appeal among investors.

Investors and Stakeholders:

Tesla has garnered a diverse group of investors, from traditional stakeholders to environmentally conscious funds. The company's charismatic CEO, Elon Musk, and its focus on cutting-edge technologies have attracted both institutional and individual investors seeking exposure to the future of transportation and energy.

Strategic Analysis and Future Outlook:

A thorough analysis of Tesla suggests a promising future, with the company leading the charge in electric vehicles, energy storage, and renewable energy solutions. Tesla's ambitious projects, such as the Gigafactories and advancements in autonomous driving, contribute to a positive outlook for long-term growth.

Tesla, Inc.'s listing on NASDAQ symbolizes a company that has not only disrupted established industries but has also become a symbol of innovation and sustainability. With a soaring share price, a transformative company profile, and a visionary leader at the helm, Tesla continues to be a compelling choice for investors seeking a stake in the future of clean energy and transportation.