Amazon.com Inc (AMZN)-NASDAQ STOCK MARKET: Amazon, the e-commerce giant founded by Jeff Bezos in 1994, has become synonymous with innovation, disruption, and exponential growth. In this comprehensive analysis, we delve into various aspects of Amazon, ranging from its share price trends to historical financial performance, investors, and future outlook.

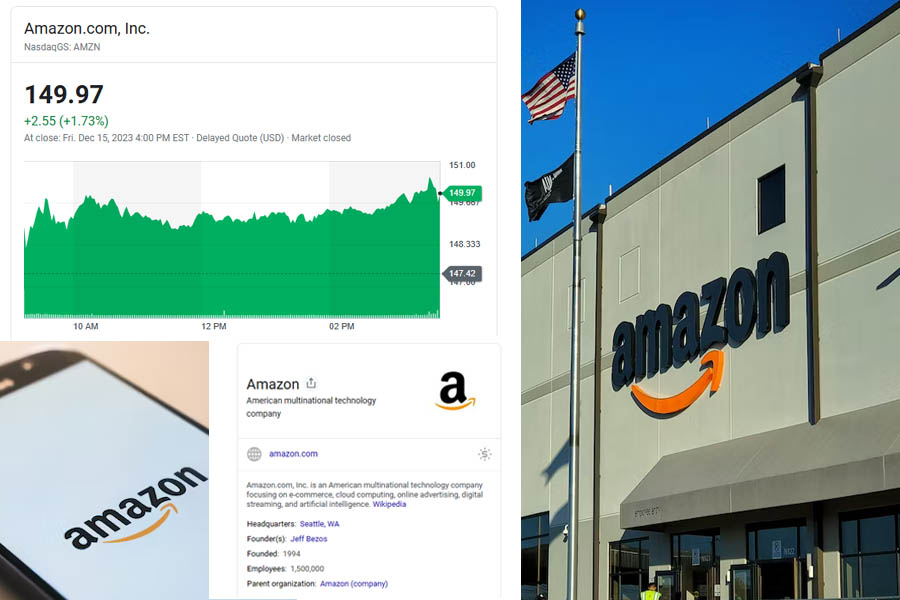

Share Price Development: As of Today Amazon.com, Inc. NasdaqGS: AMZN 149.97$ Share Price Value

Prev. Closing Price 147.42$ / 52 Weeks Low Price 81.43$ /52 Weeks. High Price: 150.56

Yearly Perspective:

Over the past year, Amazon's share price has experienced notable fluctuations, responding to market dynamics, economic conditions, and company-specific events. Investors keen on long-term prospects have closely monitored these movements, seeking opportunities amid market shifts.

Monthly and Weekly Analysis:

Breaking down the share price trends on a more granular level, monthly and weekly analyses provide insights into short-term market sentiments. Whether driven by earnings reports, product launches, or industry trends, these fluctuations reflect the agility of Amazon in navigating the ever-changing market landscape.

Company Profile:

Amazon's trajectory from an online bookstore to a global e-commerce behemoth is nothing short of remarkable. The company's commitment to customer-centric innovation, exemplified by initiatives like Amazon Prime and AWS (Amazon Web Services), has solidified its position as a leader not just in e-commerce but also in cloud computing and digital streaming.

Headquarters:

Amazon's main headquarters, often referred to as its corporate nerve center, is located in Seattle, Washington, USA. The sprawling campus, known as the Amazon Day 1 campus, is a symbol of the company's commitment to innovation and customer-centric thinking. The headquarters is not only a hub for executives and decision-makers but also a space where Amazon's culture of creativity and invention thrives.

Operational Locations:

Amazon's operational reach extends far beyond its Seattle headquarters. The company has strategically established fulfillment centers, distribution hubs, and data centers across the globe to streamline its vast network of services. Some key operational locations include:

North America:

In addition to its Seattle headquarters, Amazon has fulfillment centers and operational hubs strategically placed across the United States and Canada. Major cities, including Los Angeles, Chicago, and Toronto, host these centers, ensuring efficient delivery and logistics services.

Europe:

Europe is a significant market for Amazon, and the company has established operational bases in key European cities such as London, Berlin, and Madrid. These locations facilitate the rapid distribution of products and services to customers throughout the continent.

Asia:

Recognizing the importance of the Asian market, Amazon has a strong operational presence in countries like India, China, and Japan. Fulfillment centers and offices in cities such as Bangalore and Tokyo contribute to Amazon's market dominance in the region.

Middle East and Africa:

Amazon's expansion into the Middle East and Africa is marked by operational centers in cities like Dubai. These locations serve as vital hubs for reaching customers in a region with a growing appetite for e-commerce.

South America:

As part of its global strategy, Amazon has a presence in South American countries, with operational centers in cities like São Paulo. This allows the company to tap into the burgeoning e-commerce market in the region.

Amazon's global operational network is a testament to its commitment to providing customers with fast, reliable, and convenient services. The strategic placement of fulfillment centers and other facilities enables the company to meet the demands of a diverse and expansive customer base.

Historical Financial Performance:

A walk down Amazon's financial memory lane reveals a consistent pattern of growth. The company's revenue streams, diversified across e-commerce, cloud services, and digital entertainment, have contributed to its financial resilience. Investors often look to historical financial data to gauge Amazon's ability to weather economic storms and capitalize on emerging opportunities.

Target Price and Analysts' Projections:

Understanding Amazon's target price involves evaluating analysts' projections based on a myriad of factors, including industry trends, competitive landscape, and the company's strategic initiatives. Tracking these projections can offer investors valuable insights into the market's collective expectations for Amazon's future performance.

Investors and Stakeholders:

Amazon's investor base is diverse, ranging from institutional investors to individual shareholders. The company's shareholder structure and engagement with stakeholders, including discussions on environmental, social, and governance (ESG) factors, play a crucial role in shaping its corporate image and long-term sustainability.

Strategic Analysis and Future Outlook:

As Amazon continues to expand its reach into various industries, including healthcare and grocery, strategic analysis becomes paramount. Investors seek to understand the company's vision, risk management strategies, and its capacity for sustained innovation. The future outlook of Amazon involves anticipating its role in shaping global commerce, technology, and consumer behavior.

Amazon's journey from an online bookstore to a global tech giant is a testament to its adaptability and relentless pursuit of innovation. Investors and analysts closely scrutinize the company's share price, financial performance, and strategic initiatives to make informed decisions in a dynamic market environment. As Amazon continues to redefine industries, its story remains one of perpetual evolution and unwavering ambition.